Unreimbursed Employee Business Expenses 2024 – substantial tasks that further the corporation’s business purpose. If he does have unreimbursed employee expenses, he can only claim the amount of expenses that exceeds 2 percent of his adjusted . Your state will determine your ability to write off home-office expenses. Alabama, Arkansas, California, Hawaii, Minnesota, New York, and Pennsylvania provide a deduction for unreimbursed employee .

Unreimbursed Employee Business Expenses 2024

Source : www.linkedin.comStandard Business Mileage Rate Going up Slightly in 2024

Source : accountants.sva.comMark R. Stanhope CPA PC | Hudson MA

Source : m.facebook.comTraveling for Business in 2024? What’s Deductible? Caras Shulman

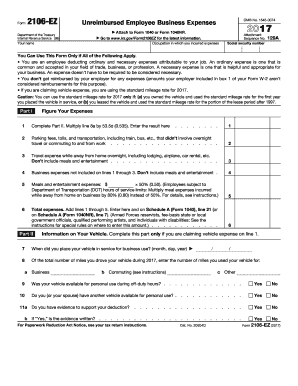

Source : www.carasshulman.comIRS 2106 EZ 2017 2024 Fill out Tax Template Online

Source : www.uslegalforms.comSIA Group | Jacksonville NC

Source : www.facebook.comTraveling for Business in 2024? What’s Deductible? – Summit CPA

Source : summit-cpa.comThe Standard Business Mileage Rate Will Be Going Up Slightly in

Source : hwco.cpaStandard Business Mileage Rate 2024 | Accounting Freedom, Ltd

Source : www.accountingfreedom.comTraveling for Business in 2024? What’s Deductible? ABIP

Source : www.abipcpa.comUnreimbursed Employee Business Expenses 2024 🚗💨 IRS announces 2024 Standard Mileage Rates! 📈💼 | SIA Group : A handful of states — Alabama, Arkansas, California, Hawaii, Minnesota, New York, and Pennsylvania — do offer a deduction for unreimbursed employee business expenses on their state returns. . Can you no longer write off business expenses? A big change was that unreimbursed employee business expenses were no longer deductible. With the filing of 2018 tax returns, business expenses that have .

]]>